Investment Management with Personal Capital

Personal Capital is wealth management for the Internet Age. Their online platform combines digital technology with highly personalized service to provide a holistic view to a unique financial picture.

Personal Capital is a powerful financial management tool that allows users to track their investments, budget and plan for retirement, and stay on top of their financial goals. It offers a range of features and tools, including portfolio tracking, investment analysis, and retirement planning, all of which are designed to help users make better financial decisions and achieve their goals.

Investment Tracking

One of the most useful features of Personal Capital is its investment tracking tool. This feature allows users to see all of their investments in one place, including stocks, bonds, mutual funds, and more. Users can track the performance of their investments over time and see how they are performing relative to the overall market. This can be a great way to stay on top of your investments and make sure that you are on track to reach your financial goals.

Budgeting and Expense Tracking

Another great feature of Personal Capital is its budgeting and expense tracking tool. This feature allows users to set budgets for different categories of expenses, such as housing, food, and transportation. Users can then track their expenses in real-time and see where they are spending their money. This can be a great way to identify areas where you can cut back on expenses and save more money.

Retirement Planning

Personal Capital also has a retirement planning tool that can help users plan for their future. This feature allows users to create a retirement plan and see how their investments will grow over time. Users can also see how much they will need to save each month in order to reach their retirement goals. This can be a great way to make sure that you are on track to retire comfortably.

Security and Privacy

Personal Capital takes security and privacy very seriously. The platform uses 256-bit SSL encryption to protect user data and all sensitive information is stored on servers that are protected by firewalls. Users can also enable two-factor authentication for added security. Additionally, Personal Capital is a registered investment advisor, which means that it is subject to strict regulations and is required to act in the best interest of its clients.

Pricing

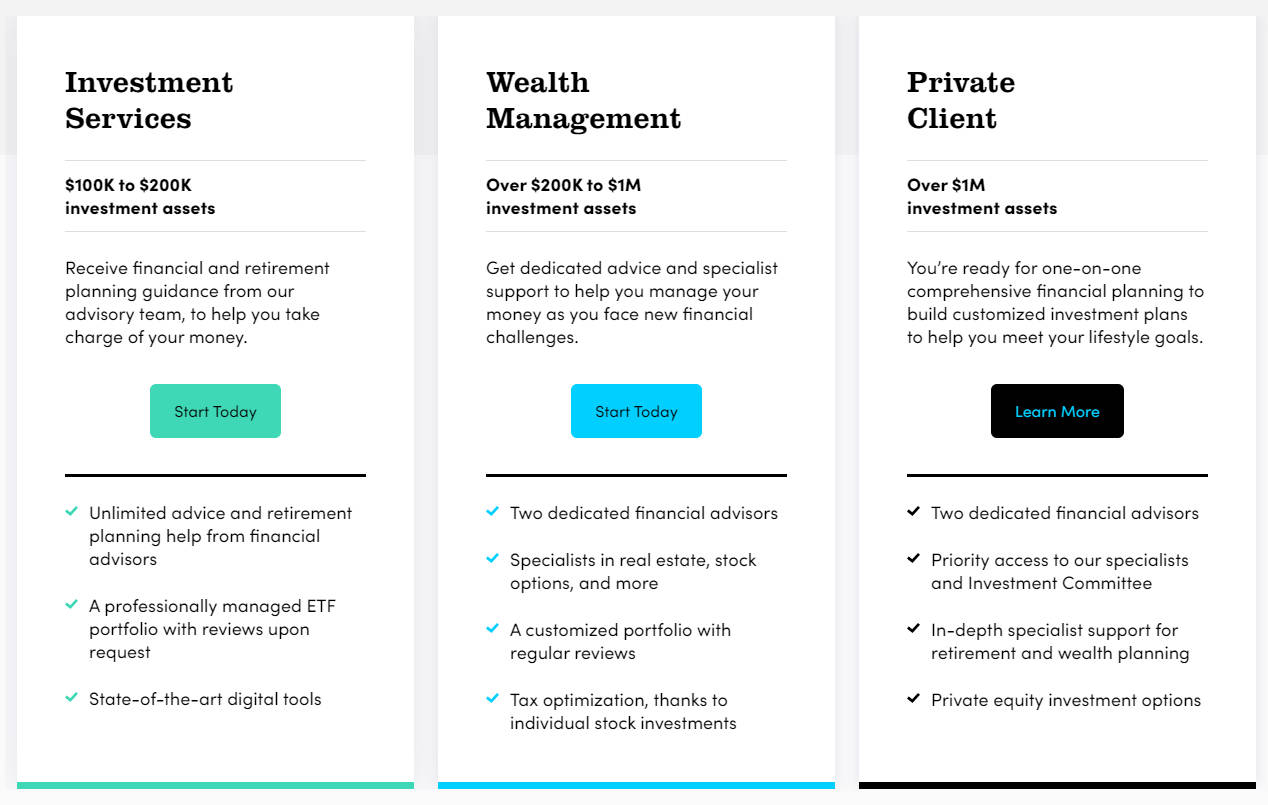

Personal Capital is free to use for investment tracking and budgeting. However, for users who want access to the platform's more advanced features, such as retirement planning and personalized financial advice, there is a fee. The cost of these services varies depending on the user's needs and investment portfolio size.

Retirement Planning

Personal Capital's retirement planning feature allows users to plan for their retirement and stay on top of their goals. Users can see how much they need to save for retirement and how much they need to invest to reach their goals. They can also see how their investments are allocated and make changes to their portfolio to optimize their investments for retirement. Additionally, users can see how their investments are projected to perform over time and see how much they will have at retirement.

Pros

- Easy to use and navigate: Personal Capital has a user-friendly interface that makes it easy for users to navigate and access all of the features and tools available. This makes it a great option for those who are not particularly tech-savvy.

- Comprehensive financial management: Personal Capital offers a wide range of financial management tools, including budgeting, investment tracking, and retirement planning. This makes it a great option for those who want to get a complete overview of their financial situation.

- Investment tracking: Personal Capital has a powerful investment tracking tool that allows users to see all of their investments in one place. This makes it easy to track performance and make informed investment decisions.

- Retirement planning: Personal Capital has a retirement planning tool that helps users plan for their future by providing them with a detailed analysis of their current financial situation and helping them set goals for the future.

- Free to use: Personal Capital is completely free to use, which makes it a great option for those who are looking for a comprehensive financial management tool without having to pay a monthly fee.

Cons

- Limited account connectivity: Personal Capital only supports a limited number of financial institutions, which means that users may not be able to connect all of their accounts to the platform.

- Limited investment options: Personal Capital only supports a limited number of investment options, which may not be suitable for some users.

- No tax planning: Personal Capital does not offer tax planning tools, which may be a drawback for some users.

- Limited customer support: Personal Capital does not offer live customer support, which means that users may have to wait for a response if they have any questions or issues.

Conclusion

Personal Capital is a great online financial management tool that can help users track their investments, budget their expenses, and plan for retirement. With its comprehensive dashboard, investment tracking tool, and budgeting and expense tracking tool, Personal Capital makes it easy for users to stay on top of their financial situation. Additionally, the platform's security and privacy measures ensure that user data is protected at all times. Overall, Personal Capital is a great choice for anyone looking to take control of their finances and reach their financial goals.

No comments:

Post a Comment